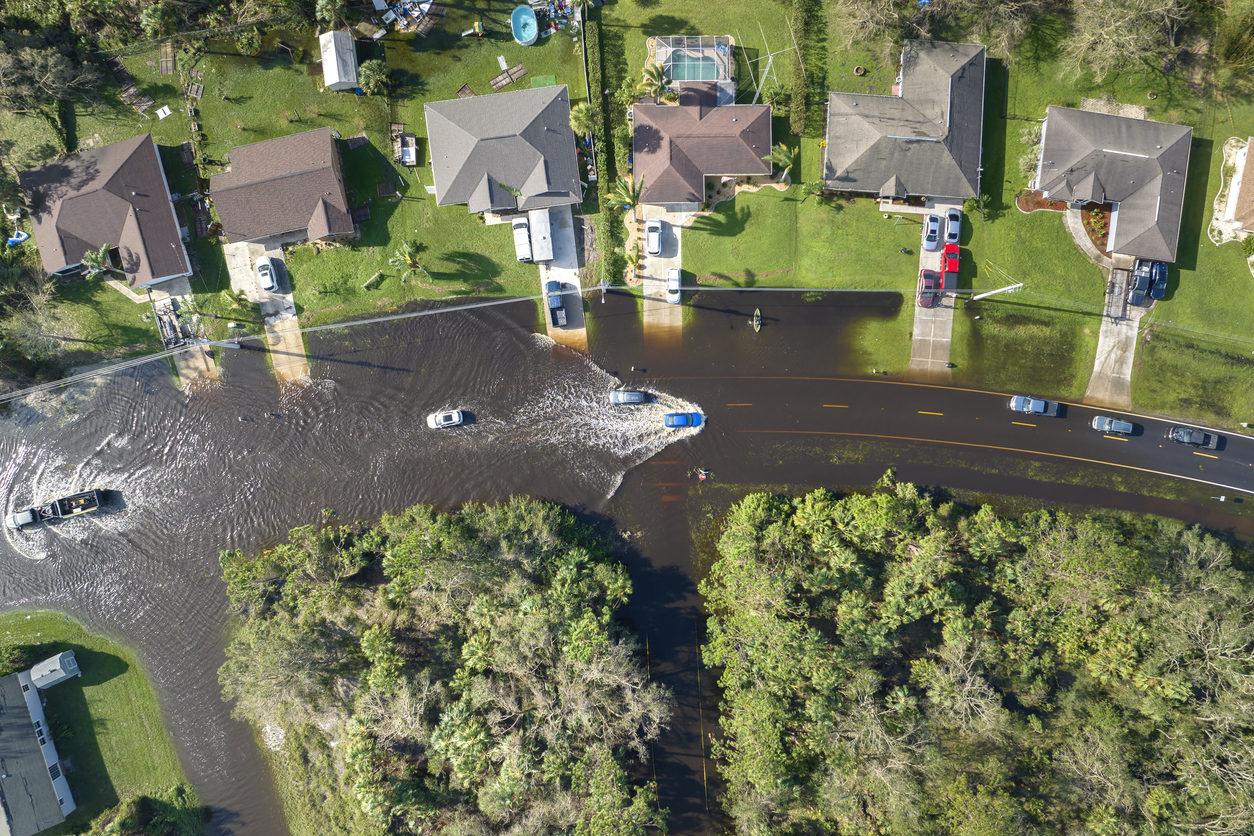

Homeowners across the U.S. are increasingly wondering if their insurance through the National Flood Insurance Program (NFIP) will cover them in the event of a flood. SMW is here to set you straight on your NFIP policy.

First off, the NFIP policy is not intended to make policyholders whole after a flood – only to get them some relief in the event of a flood. What exactly qualifies as a flood for NFIP coverage purposes? In most NFIP policies, “flood” means:

A general and temporary condition of partial or complete inundation of normally dry land areas due to any of the following:

(1) Overflow of inland or tidal waters from a natural or man-made body of water, including:

(a) Waves, such as tidal wave and tsunami;

(b) Storm surge; and

(c) Spray from any such overflow; all whether driven by wind or not

(2) Unusual or rapid accumulation or runoff of surface waters from any source, including release of water from a:

(a) Dam;

(b) Levee;

(c) Seawall; or

(d) Other similar boundary or containment system; or

(3) “Mudslide or mudflow” caused by flooding as defined in 5.a.(1) and 5.a.(2) above.

b. Collapse or sinking of land along the shore of a body of water as a result of erosion or undermining caused by waves or currents of water which exceed cyclical levels and cause flooding as defined in 5.a.(1) above.

All flooding in a continuous or protracted event will constitute a single occurrence of “flood”.

The over-arching question is always: are you covered? If you only have a flood policy through NFIP, then the answer may be no. In residential policies, the coverage limit for a single-family residence is $250K for the structure and $100K for personal property. The maximum coverage limit for businesses is $500K for the building and $500K for your business personal property.

This is important to understand because, in our experience, people who buy a flood policy through NFIP think they have comprehensive flood insurance. This is a myth. In fact, these policies are not only limited by dollar values, but are also limited in what they cover. NFIP policies are limited when it comes to damage that is below-grade/in the basement – that is, related to flooding. In these areas, coverage is limited to unfinished drywall, insulation, mechanicals, plumbing, and electrical – and doesn’t cover paint, wallpaper or flooring.

So, if you have a policy through NFIP, read through it very carefully to understand what is covered and what is not. If you want full flood insurance protection, you will have to purchase a complementary policy through a private insurance provider. It may be costly depending on the location of your property, but it will be worth it in the event of major flood damage.

Now let’s talk about the property policy for a moment and how that could come into play. Oftentimes when there is a major storm, there are both windstorm and flooding damages. Flood policies don’t cover windstorm damage and property rarely cover flooding. So how do we unravel all of this? Unless you have a ring camera set up to show the entire storm and what event happened in what sequence, it’s a major challenge to decipher multiple issues potentially happening at the same time.

To further complicate this jumbled matter, what happens when there is anti-concurrent causation language in the policy? The premise of anti-concurrent causation is that if there are multiple causes of loss involved in a claim and one of those causes is excluded from coverage (although the others may be covered), the entire loss is not covered. This is why it’s crucial to RTFP!