In my early days as a public adjuster, I worked with a grizzled old pro who was a leading flood adjuster. He once concisely explained to me the basic purpose of NFIP flood insurance:

“The point is to get homeowners some relief – it’s not supposed to make you whole.”

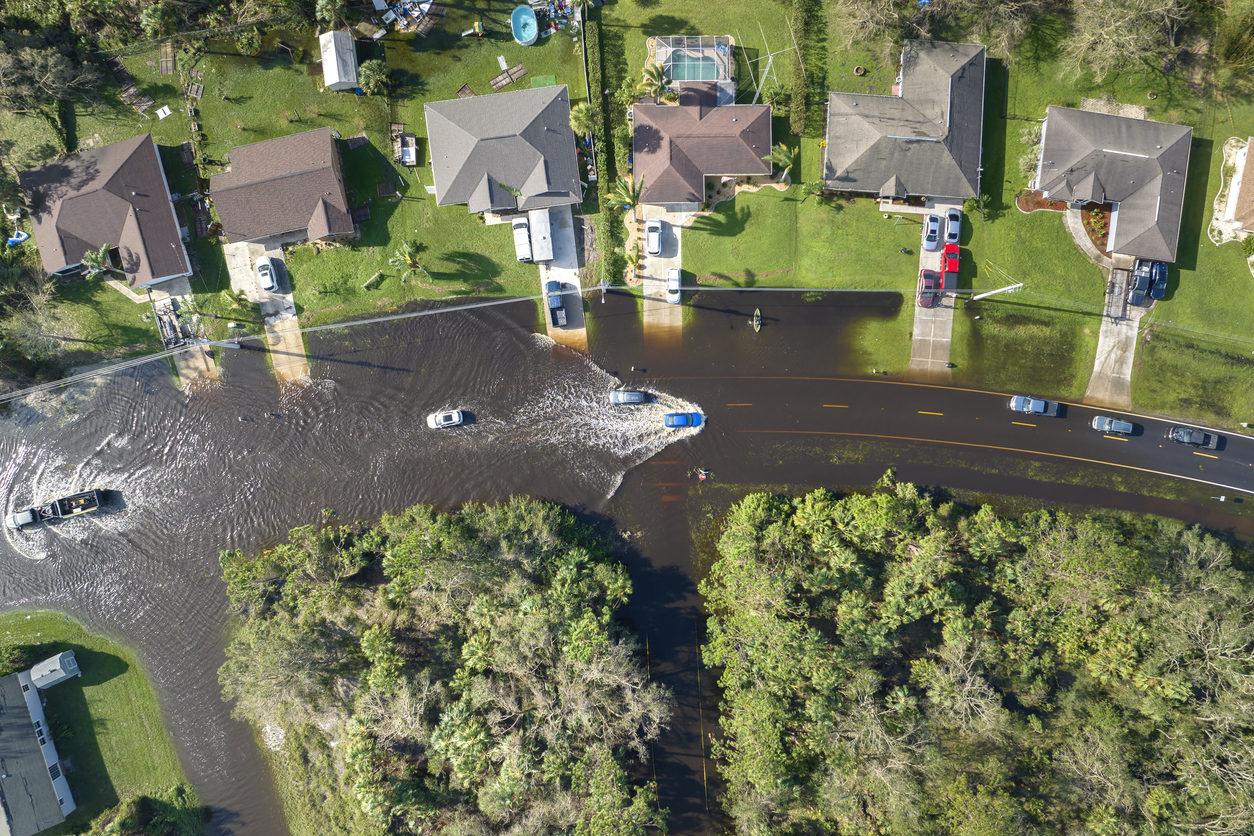

I’ve been thinking about that pithy summary as Hurricane Florence barrels towards the East Coast. Forecasters are calling Flo a “once in a lifetime” storm that might hit the Carolinas with torrential rain, high winds, and a deadly storm surge that could uproot trees, cripple power lines, and dump more than 3 feet of floodwater in several coastal areas.

If you run a business or live anywhere near this area, you’re no doubt asking yourself one key question: Am I covered?

You may not be fully covered if you only have a flood policy through NFIP. In residential policies, the coverage limit for a single family residence is $250K for the structure and $100K for personal property. The maximum coverage limit for businesses is $500K for the building and $500K for your business personal property.

This is important to understand because, in my experience, people who buy a flood policy through NFIP think they have comprehensive flood insurance.

This is a myth!

In fact, these policies are not only limited by dollar values but also limited in what is covered. NFIP policies are limited when it comes to damage that is below-grade – that is, related to flooding. These policies mainly cover unfinished drywall, insulation, mechanicals, plumbing, electrical but not paint, wallpaper and flooring.

So, if you have a policy through NFIP, read through it very carefully to understand what is covered and what is not. If you want full flood insurance protection, you will have to purchase a complementary policy through a private insurance provider – it may be costly depending on the location of your property. It will be worth it, of course, in the event of major flood damage.

But if you only have a flood policy through NFIP, give it a good read and understand what it actually covers. Remember: it’s only supposed to help you get you back on your feet – not make you entirely whole after a flood loss.