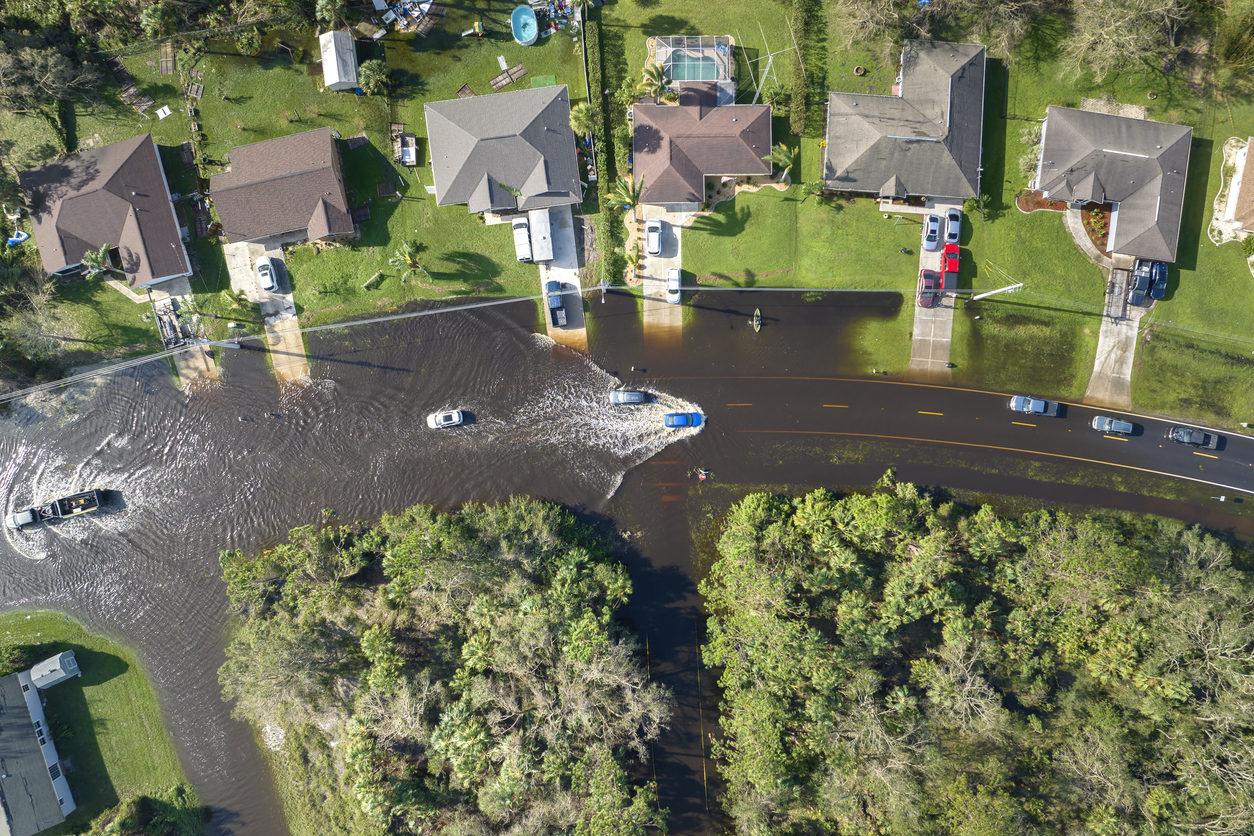

Surface water is an excluded loss under insurance policies, except for flood insurance policies. But what is “surface water” exactly?

If a water main breaks under the street in front of your home, and the water enters your basement causing damage to your mechanical room, is this damage covered? Once the broken pipe’s water flows to the surface of the ground, does it become surface water, thereby excluding it under your homeowner’s policy?

Let’s examine some actual policy language. The exclusion for surface water reads:

SECTION I – EXCLUSIONS

A. We do not insure for loss caused directly or indirectly

by any of the following. Such loss is excluded

regardless of any other cause or event

contributing concurrently or in any sequence to the

loss. These exclusions apply whether or not the

loss event results in widespread damage or affects

a substantial area.

Water Damage

Water Damage means:

a. Flood, surface water, waves, tidal water,

overflow of a body of water, or spray from

any of these, whether or not driven by wind;

b. Water or water-borne material which backs

up through sewers or drains or which overflows

or is discharged from a sump, sump

pump or related equipment; or

c. Water or water-borne material below the

surface of the ground, including water

which exerts pressure on or seeps or leaks

through a building, sidewalk, driveway,

foundation, swimming pool or other structure;

caused by or resulting from human or animal

forces or any act of nature.

Direct loss by fire, explosion or theft resulting

from water damage is covered.

Because the term surface water is not defined in the policy, the plain meaning of the words is what defines the term. A ‘surface’ is “the outer face, outside, uttermost layer”, and ‘water’ is a “transparent, odorless, tasteless liquid made up of hydrogen and oxygen”. After reading the plain meaning of surface water, the example of the broken pipe’s water could be considered just that.

Or could it? As one can read in the insurance policy, surface water is surrounded by the words ‘flood,’ ‘waves,’ ‘tidal water,’ and ‘overflow of a body of water.’ When reading a policy or contract, the verbiage chosen around the words help to define the word. In the insurance policy, all of the words that surround the term “surface water” are items originating from natural causes. An ocean, river or sea may cause flooding, as could excess rain and tidal surges. None of these losses are covered under a standard homeowner’s policy – this was the intent of the policy.

As for a water main break that causes damage to your home, that loss IS covered. Water escaping from a broken pipe is a fortuitous event, and the water was not a body of water that naturally occurred. The pipe was put there by the municipality or city and does not occur naturally.

SMW has seen insurance companies deny these and other types of claims, stating that as soon as any water travels across land, it becomes surface water and is not covered. Another example of this would be an above-ground pool collapsing, leaking water across the yard and filling a neighbor’s basement. The homeowner whose basement was filled with pool water put in an insurance claim, and the insurer denied coverage stating that surface water was not covered. This is not accurate, but some people believe what their insurance company tells them without having their policy read by a professional.

Ultimately, every coverage determination is specific to both the facts and your insurance policy language. SMW is available to read your policy and advise.