May flowers bring pilgrims, and June brings…floods.

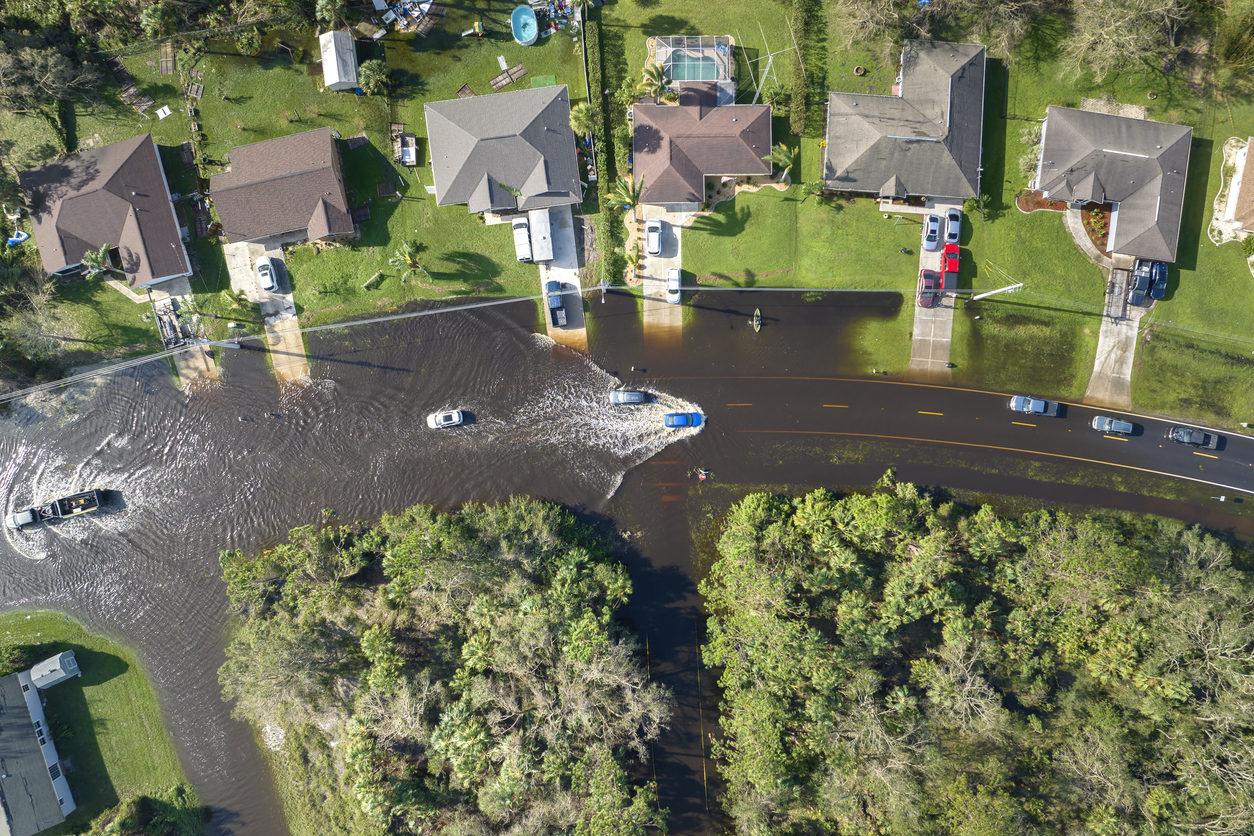

As summer storms roll in, homeowners should think about their insurance coverage for floods. That’s because we’re entering the season of hurricanes – and that often means torrential rain, high winds, and storm surges. These can result in uprooted trees, crippled power lines, and floodwater across entire regions.

First off, let’s understand exactly what floods entail, as far as your National Flood Insurance Program (NFIP) policy is concerned. In most NFIP policies, “Flood” means:

a. A general and temporary condition of partial or complete inundation of normally dry land areas due to any of the following:

(1) Overflow of inland or tidal waters from a natural or man-made body of water, including:

(a) Waves, such as tidal wave and tsunami;

(b) Storm surge; and

(c) Spray from any such overflow; all whether driven by wind or not

(2) Unusual or rapid accumulation or runoff of surface waters from any source, including release of water from a:

(a) Dam;

(b) Levee;

(c) Seawall; or

(d) Other similar boundary or containment system; or

(3) “Mudslide or mudflow” caused by flooding as defined in 5.a.(1) and 5.a.(2) above.

b. Collapse or sinking of land along the shore of a body of water as a result of erosion or undermining caused by waves or currents of water which exceed cyclical levels and cause flooding as defined in 5.a.(1) above.

All flooding in a continuous or protracted event will constitute a single occurrence of “flood”.

With that definition in hand, let’s understand another important point about your NFIP coverage: It’s intended to get homeowners some relief – not make them whole.

Now let’s get to the next key question: are you covered?

If you only have a flood policy through NFIP, then the answer may be ‘No’. In residential policies, the coverage limit for a single-family residence is $250K for the structure and $100K for personal property. The maximum coverage limit for businesses is $500K for the building and $500K for your business personal property.

This is important to understand because, in our experience, people who buy a flood policy through NFIP think they have comprehensive flood insurance.

This is a myth!

In fact, these policies are not only limited by dollar values but also are limited in what they cover. NFIP policies are limited when it comes to damage that is below-grade – that is, related to flooding. These policies mainly cover unfinished drywall, insulation, mechanicals, plumbing, electrical but not paint, wallpaper and flooring.

So, if you have a policy through NFIP, read through it very carefully to understand what is covered and what is not. If you want full flood insurance protection, you will have to purchase a complementary policy through a private insurance provider – it may be costly depending on the location of your property. It will be worth it, of course, in the event of major flood damage.

But if you only have a flood policy through NFIP, give it a good read and understand what it actually covers. Remember: it’s only supposed to help you get you back on your feet – not make you entirely whole after a flood loss.