WHAT IS AN IMPROVEMENT OR BETTERMENT?

Improvements and Betterments are defined in the ISO coverage forms as “fixtures, alterations, installations or additions made to part of the building or structure you occupy but do not own; and you acquired or made at your expense but cannot legally remove.” Since the improvements are permanent repairs to the building, the lessee is insuring their use interest in the improvement or betterment.

WHAT THE COVERAGE IS:

The improvements and betterments coverage exists as part of the Business Personal Property coverage limit in the Building and Personal Property Coverage Form (CP 00 10) and the Business Owners Coverage Form (BP 00 03). Therefore, when insuring your business, be certain your insurance agent knows if you are planning to perform renovations to the property you are leasing. The renovations need to be insured properly under the correct coverage in the policy.

In order to make claim for improvements and betterments, it is necessary to show the insurer that the lessee installed the improvements at their own expense. The insurer may require proof of the work, i.e., paid invoices and cancelled checks.

PAYMENTS UNDER POLICY:

Under the Loss Payment section in the policy for Tenants’ improvements and betterments; payment calculation is as follows:

(a) Replacement cost if you make repairs promptly;

(b) A proportion of your original cost if you do not make repairs

promptly. We will determine the proportionate value as follows:

(i) Multiply the original cost by the number of days from the loss or damage to the expiration of the lease; and

(ii) Divide the amount determined in (i) above by the number of days from the installation of improvements to the expiration of the lease.

If your lease contains a renewal option, the expiration of the renewal option period will replace the expiration of the lease in this procedure.

(c) Nothing if others pay for repairs or replacement

After a major loss, loss payment (b) is the most common payment option. Therefore, the tenant is only collecting on a pro-rata basis for the Improvements.

LEASE

The wording in the lease typically speaks to who is responsible for the repair work after a casualty loss. Every lease is different, so the party responsible for performing the repairs should be spelled out in the lease. Just because your lease requires you to maintain the HVAC system does not require your insurer to pay for a new HVAC system if the system is damaged by a fire. The HVAC system must have been an improvement made by the tenant in order for coverage to apply or specifically called out to be insured by the lease. Providing your insurance agent your lease is extremely important. Your agent can understand your requirements and make sure you have the proper policy and limits of insurance.

TRADE FIXTURES

Each business has unique features that may be considered trade fixtures as opposed to an Improvement or Betterment. For example, a business that sells books may have installed several shelving units to display the items for sale. Just because the shelves are affixed to the building, they are not necessarily an Improvement or Betterment; they could be a trade fixture. Trade fixtures are items that may be attached to the building but that the tenant is able to legally remove upon completion of the lease. It is important to differentiate a trade fixture from an Improvement or Betterment because the loss payment for the trade fixture can be at replacement cost while the Improvement or Betterment may be settled at a pro-rata payment.

CONCLUSION

Improvements and Betterments are difficult claims, and disputes often arise between the insured and the insurer. If possible, make certain the language in the lease is clear and concise in regards to specific coverage for the improvements made. Clearly list and attach to the lease improvements that you make at your own expense and provide that information to your agent or broker.

EXAMPLES

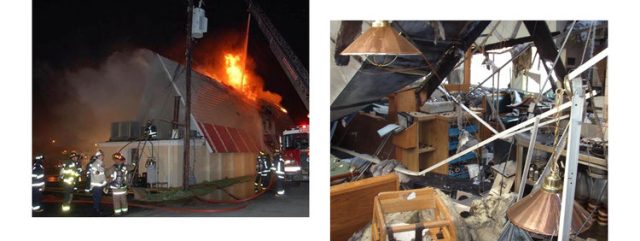

SMW handled a total loss to a building that was leased by a restaurant group. Under the terms of the lease, the tenant was not only required to insure their business personal property, but also the entire building. Fortunately, the tenant had the proper coverage, and the building and all of the Improvements were covered by the tenant’s insurer.

SMW handled a water loss for a tenant who built out the entire first floor of a commercial building that had apartments above. A pipe burst in one of the apartments and the commercial space was severely damaged. The commercial tenant had coverage under their Business Personal Property coverage but was grossly underinsured when it came to the costs of the buildout. The agent was not notified that the tenant paid for all of the improvements and betterments. Therefore, the limit of liability for the BPP coverage was only intended for the stock, furniture and fixtures of the tenant. The tenant was not able to rebuild after the loss.

IF YOU HAVE ANY QUESTIONS OR COMMENTS, PLEASE FEEL FREE TO CONTACT SWERLING MILTON WINNICK AT 781-416-1000 OR EMAIL US AT DIANE@SWERLING.COM.