SMW recently learned about a troubling new, and probably illegal, practice that harms holders of insurance policies. Pushed primarily by non-admitted property insurers, this practice tries to prohibit policyholders from using public adjusters (PAs).

How are these non-admitted insurance carriers introducing these illegal policy provisions? They’re doing so by issuing policies that quietly include “Anti-Public Adjuster” endorsements in their policies. This anti-PA language effectively forces insureds, as a condition precedent to getting insurance, to agree to never retain a PA for insurance claim work in the event of a property loss.

This is an incredibly urgent matter for insurance agents, business owners, and the general public. Anti-PA endorsements negatively impact all insureds, not to mention public adjusters and their ability to perform their statutorily-authorized work. These restrictive provisions are contrary to public policy and to legislation expressly permitting public adjusters to provide this assistance.

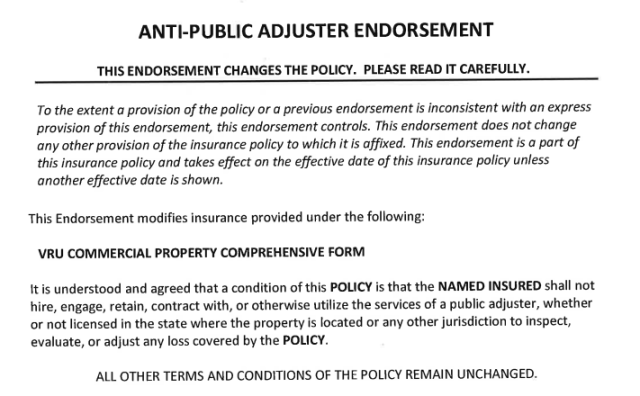

The following is an example of an anti-PA endorsement that recently appeared – unbeknownst to both the insurance agent and the insured – in the policy of one of SMW’s clients:

Anti-PA endorsements like this represent a concerted and intentional course of illegal conduct. They harm insureds to inflate the profit of property insurers while crushing PAs’ ability to make a living.

PAs are licensed in 46 of the 50 United States. Public adjusters are the only professionals licensed to prepare first-party property loss claims and present these claims to an insurance carrier on behalf of insureds who sustain a property loss. PAs are fully regulated, acting under the regulatory authority of each state’s insurance department. Meanwhile, the non-admitted carriers issuing these anti-PA endorsements typically do not have to file forms or get approval of policy provisions and endorsements from the relevant State Insurance Department.

SMW is fighting this illegal push by non-admitted carriers to strip away rights from policyholders. We’re in touch with state Attorneys General, and are identifying potential litigants who can serve as plaintiffs in our legal strategy. This is a critical battle against illegal policy provisions, and will determine whether or not insureds are able to exercise their right to hire a public adjuster to assist in adjusting their first-party property insurance claims.

Your takeaway: Insurance agents must be on the lookout for this new endorsement when selling insurance policies – otherwise they will be doing a great disservice to their trusted clients. And to policyholders everywhere – when you’re buying a new policy or renewing an expiring one, protect your rights by making sure this endorsement is not included.

Don’t hesitate to contact us if you want more information about this critical issue.